State Budget Process

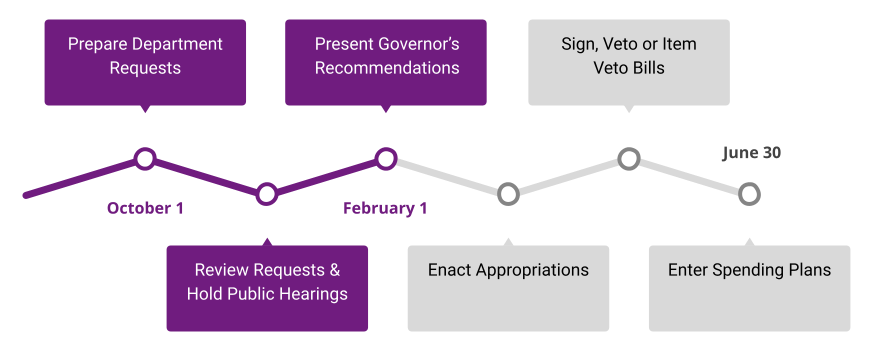

Preparation, deliberation, and execution of the budget is a continual process throughout the year. The budget process starts when the Department of Management sends out annual budget instructions.

Basis of Budgeting

Iowa’s budget is prepared on a modified cash basis that is used to establish and ensure compliance with enacted budgets according to applicable statutes and administrative procedures. For each fund except for the General Fund, the total amount appropriated or budgeted to be spent may not exceed the fiscal year’s estimated revenues available plus the unappropriated surplus fund balance (or less a deficit) of the preceding year. The fiscal year begins July 1 and ends on June 30.

For budgeting purposes, with the modified cash basis of budgeting, tax receipts are recorded at the time of deposit during the fiscal year, and during the accrual period are determined when earned and adjusted back to the appropriate fiscal year. All other receipts are deposited to the appropriate fiscal year in which the revenues were earned if received within 60 days after the end of the fiscal year; if received after those 60 days, they are recorded in the fiscal year received. For expenditures, statute requires that no payment for goods or services may be charged subsequent to the last day of the fiscal year unless the goods or services are received on or before the last day of the fiscal year, except that repair projects, purchase of specialized equipment and furnishings, and other contracts for services and capital expenditures for the purchase of land or erection of buildings or new construction or remodeling which were committed and in progress prior to the end of the fiscal year are excluded. In other words, except for the previously mentioned exceptions, the State must have received the goods or services on or before June 30, creating an actual liability.

Back to topState Budget Practices & Considerations

Reserve Funds

Maintaining reserve funds is crucial in ensuring fiscal sustainability. That does not mean the funds should never be used; they are clearly in place for emergencies. However, a balanced approach in using the reserves is important to maintain structural budget balances.

Use One-time Funding

Using one-time funding for ongoing operations creates a structural gap in the budget. One-time funds should be identified and used only for one-time purposes.

Biennial Budgeting

Biennial budgeting helps remove the incremental cost increases that creep into base budgets simply due to the fact that the budget is created annually. Biennial budgeting will also provide additional funding stability to those entities dependent on state resources and help smooth the highs and lows that can occur with annual budgeting.

Long-term Planning

A five-year financial plan for state government allows the Governor and Legislature to better track the long-term impacts that taxing and spending decisions have on the ability of the state to balance its budget, meet critical needs, and avoid budget cliffs for years into the future.

Back to top